Objective: Increasing NPS (Net Promoter Score) through enabling memorable customer experiences

Result: Launch of customer service digital transformation and taking NPS from -17 to -1

Background

Royal Bank of Scotland needed a framework and a narrative to deliver a massive internal restructuring in customer service to be headed by Simon Separghen (previously of Barclays Bank plc). In essence, the project required a culture change while digital transformation was brought on-board to the bank.

Brief

Invent a narrative and vision to drive a culture change in delivering exciting and memorable customer experiences from customer service agents, colleagues and community. The stages for transformation were set at

Solutions

A number of concepts were created from future revolutions & the technological revolution to augmenting the future and finally we settled on the adventure paradigm of discovering the future together with our customers and enabling the human touch through adaptive technology and digital first modelling. From this we worked to produce the mechanisms for behaviour change.

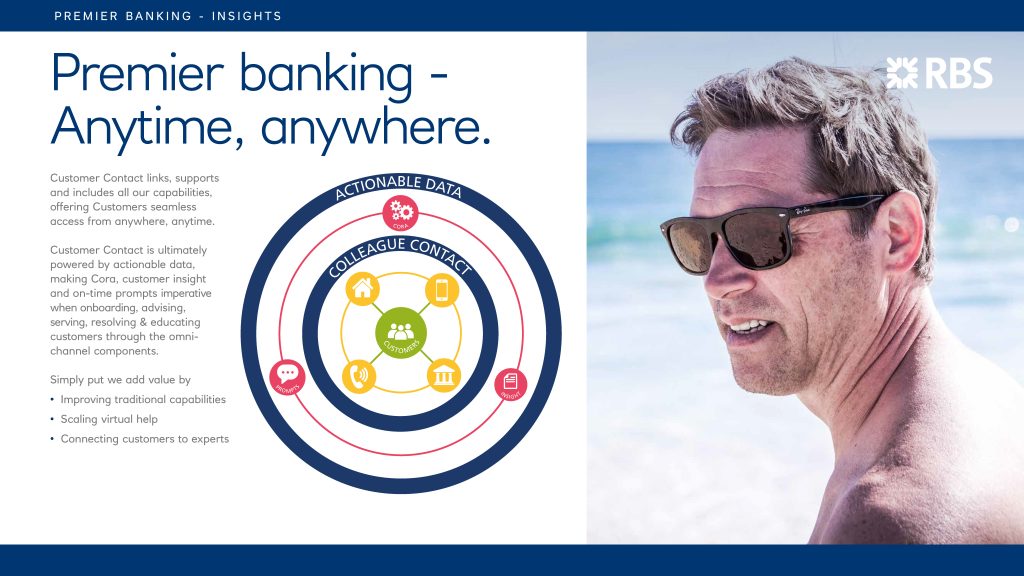

Building upon anytime, anywhere customer experiences we launched with premier banking services, as this was a smaller cohort of operatives to measure the success metrics and to adjust and change any failings in our roll out of the change solutions.

Outcomes

With a NPS of -17 in 2017 RBS has progressed to an NPS of -1 – a considerable and progressive change to a customer service work force of over 10,000 strong. This improvement is not just down to a clear vision and plan, but it has certainly helped to drive change within the organisation in a positive and transformative direction.

Summary

RBS continues to refine and improve its culture change narrative, and continue to improve. Their objective is to offer the best customer experience, anywhere at any time.